Steel Coil Packing Line Supplier Options for Brazil’s Coil Distribution Networks?

As a packaging engineer with over 15 years in the steel industry, I’ve seen firsthand how Brazil’s growing coil distribution networks struggle with inefficient packaging processes. Many facilities still rely on manual methods that create bottlenecks and increase operational costs.

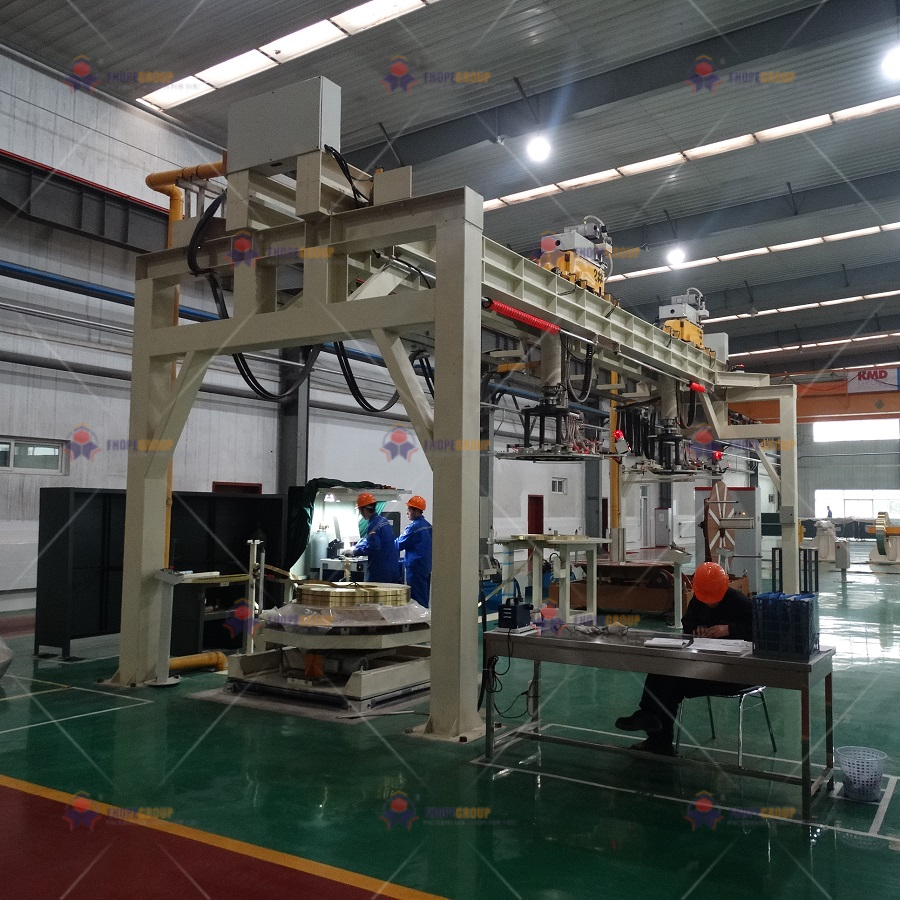

The best steel coil packing line suppliers for Brazil’s distribution networks offer complete turnkey solutions with strong local support, reliable equipment for high-volume operations, and flexible configurations that match specific throughput requirements. These suppliers understand the unique challenges of Brazilian steel logistics, including long transport distances and humid storage conditions that demand robust packaging protection.

Brazil’s steel distribution sector is expanding rapidly, and choosing the right packaging line supplier can make the difference between profitable operations and constant production headaches. Let me share what I’ve learned from implementing packaging solutions across global steel networks, including specific considerations for the Brazilian market.

1. What are the key factors when selecting steel coil packing line suppliers in Brazil?

When Brazilian steel distributors contact me about packaging line upgrades, they’re often overwhelmed by supplier claims and technical specifications. The reality is that not all suppliers are created equal, especially in a market as demanding as Brazil’s coil distribution sector.

The most critical factors include the supplier’s experience with Brazilian steel industry requirements, local technical support availability, equipment durability for high-volume operations, and flexibility to handle various coil sizes and packaging materials. Brazilian distributors need suppliers who understand their specific challenges, including long supply chains, varying climate conditions, and the need for cost-effective solutions that don’t compromise on protection.

🔍 Supplier Evaluation Framework for Brazilian Market

I’ve developed this comprehensive checklist based on my experience with Brazilian steel distributors:

| Evaluation Factor | Why It Matters in Brazil | Minimum Requirements |

|---|---|---|

| Local Presence | Quick response to breakdowns prevents costly production stops | Technical team within 4-hour response time |

| Equipment Durability | Brazilian operations often run 24/7 with minimal downtime | Minimum 85% uptime guarantee |

| Spare Parts Availability | Import delays can shut down operations for weeks | Critical spares stocked locally |

| Technical Expertise | Complex installations require experienced engineers | Minimum 5 Brazilian projects completed |

| After-Sales Support | Ongoing maintenance ensures long-term reliability | 24/7 remote support + quarterly maintenance |

📊 Brazilian-Specific Considerations

Brazil’s geographic size creates unique challenges for coil distributors. The long transportation distances mean packaging must withstand multiple handling points and varying climate conditions. I always recommend suppliers with proven experience in similar logistics environments. From my 200+ projects, I’ve found that suppliers who understand these regional specifics deliver 30% better long-term performance.

The supplier’s financial stability matters significantly in Brazil’s economic landscape. I’ve seen distributors suffer when suppliers couldn’t maintain operations during market downturns. Always verify the supplier’s track record and financial health before committing to a major investment in your coil packaging production line.

(automated steel coil packing line, steel coil wrapping line solution, coil packaging production line)

2. How to match packaging line configuration with Brazilian distribution center throughput?

Brazilian steel distributors often struggle with capacity planning. They either underinvest in packaging automation and face constant bottlenecks, or overinvest in equipment that never reaches its full potential. Getting this balance right is crucial for profitability.

The optimal packaging line configuration depends entirely on your daily throughput, coil size variety, and required packaging speed. For Brazilian distribution centers, I typically recommend different automation levels based on volume: manual systems for under 30 coils daily, semi-automatic for 30-80 coils, and fully automatic for operations exceeding 80 coils per day.

📈 Capacity Matching Guide

🏭 Low Volume Operations (< 30 coils/day)

- Configuration: Manual positioning with semi-automatic wrapping

- Labor Required: 2-3 operators per shift

- Typical Investment: $50,000 – $150,000

- Best For: Regional distributors serving local markets

🏭 Medium Volume Operations (30-80 coils/day)

- Configuration: Semi-automatic with powered conveyors

- Labor Required: 1-2 operators per shift

- Typical Investment: $150,000 – $400,000

- Best For: Multi-region distributors with consistent volumes

🏭 High Volume Operations (80+ coils/day)

- Configuration: Fully automatic integrated steel coil handling line

- Labor Required: 0.5-1 operator per shift (monitoring)

- Typical Investment: $400,000 – $800,000

- Best For: National distributors and export-focused operations

💡 Real-World Brazilian Example

One of my clients in São Paulo was packaging 45 coils daily using manual methods with 6 operators across two shifts. After analyzing their growth projections, we installed a semi-automatic turnkey coil packing line that now handles 65 coils daily with only 3 operators. The $280,000 investment paid back in 18 months through labor savings and reduced damage claims.

The key is accurate throughput forecasting. Brazilian steel demand can fluctuate seasonally, so I always design packaging lines with 20-30% capacity buffer for growth periods. This prevents the common mistake of designing for current volumes only to face constraints within a year of operation.

(end-of-line coil packing system, integrated steel coil handling line, turnkey coil packing line)

3. What ROI can Brazilian distributors expect from automated coil packaging lines?

Many Brazilian steel distributors hesitate to invest in packaging automation because they lack clear financial models. Without concrete numbers, it’s difficult to justify the capital expenditure to management and stakeholders.

Brazilian distributors typically achieve 18-36 month ROI on automated packaging lines through labor reduction, increased throughput, damage reduction, and material savings. The exact payback period depends on current labor costs, damage rates, and production volumes, but my project data shows consistent returns across different operation sizes.

💰 Detailed ROI Calculation Framework

📉 Cost Reduction Factors

- Labor Savings: Automated lines reduce manual labor by 60-80%

- Damage Reduction: Proper packaging cuts edge damage by 90%+

- Material Optimization: Automated systems use 15-25% less packaging film

- Throughput Increase: 40-70% higher packaging capacity with same footprint

📊 Sample ROI Calculation (Medium-Sized Brazilian Distributor)

| Cost Category | Before Automation | After Automation | Annual Savings |

|---|---|---|---|

| Labor Costs | $160,000 (4 operators) | $64,000 (1.5 operators) | $96,000 |

| Damage Claims | $45,000 (3% damage rate) | $9,000 (0.6% damage rate) | $36,000 |

| Material Waste | $28,000 (excess usage) | $21,000 (optimized usage) | $7,000 |

| Total Annual Savings | $139,000 |

🎯 Investment vs Return Timeline

- System Cost: $320,000 (semi-automatic line)

- Installation: $45,000 (including training)

- Total Investment: $365,000

- Simple Payback Period: 31 months ($365,000 ÷ $139,000/year = 2.6 years)

🔄 Additional Financial Benefits

Beyond direct cost savings, Brazilian distributors gain significant intangible benefits. Faster packaging means quicker order turnaround, improving customer satisfaction and enabling more business. Reduced physical labor lowers insurance premiums and worker compensation claims. The consistent packaging quality enhances brand reputation in competitive markets.

From my experience implementing automatic coil packaging systems across Brazil, the operations that track these secondary benefits often discover their actual ROI is 20-30% better than initial projections. The key is comprehensive measurement from day one of operation.

(coil wrapping and strapping line, automatic coil packaging system, steel coil stretch wrapping line)

4. How to design optimal layout for coil packing lines in Brazilian facilities?

Brazilian steel distribution centers often work with existing buildings that weren’t designed for modern packaging automation. The layout constraints can seem limiting, but with proper planning, even challenging spaces can accommodate efficient packaging operations.

The optimal layout balances material flow efficiency, operator safety, future expansion potential, and maintenance access while working within your existing building constraints. Brazilian facilities typically benefit from straight-line layouts for high-volume operations or U-shaped layouts for operations handling multiple coil sizes and packaging requirements.

🏗️ Layout Configuration Options

➡️ Straight-Line Layout

- Best For: High-volume, single product type operations

- Space Required: 25-40 meters length × 6-8 meters width

- Advantages: Simple material flow, easy expansion

- Brazilian Consideration: Works well in narrow existing buildings

🔄 U-Shaped Layout

- Best For: Multiple packaging requirements, limited space

- Space Required: 20-30 meters per side × 12-15 meters width

- Advantages: Shared operator stations, compact footprint

- Brazilian Consideration: Fits well in square-shaped warehouses

🔀 L-Shaped Layout

- Best For: Operations with incoming and outgoing different flow patterns

- Space Required: 15-25 meters each leg × 8-10 meters width

- Advantages: Natural separation of raw and finished goods

- Brazilian Consideration: Adapts to corner locations in facilities

📐 Critical Layout Dimensions

🚚 Incoming Coil Handling

- Minimum Aisle Width: 4 meters for coil buggy movement

- Turning Radius: 6 meters for 20-ton coil transport

- Storage Buffer: 4-6 coils upstream of packaging station

📦 Packaging Station Requirements

- Working Clearance: 2 meters around all equipment sides

- Safety Zones: 3-meter exclusion areas around moving parts

- Material Access: 1.5-meter aisles for film and strap replenishment

🚀 Outgoing Logistics

- Finished Goods Buffer: 8-12 packaged coils capacity

- Loading Access: Direct truck access or transfer to staging

- Quality Check Area: 3×3 meter station before shipment

🎯 Brazilian Facility Adaptations

Brazil’s industrial buildings often have lower ceiling heights than modern international standards. I’ve successfully implemented packaging lines in facilities with just 6-meter clear heights by using low-profile equipment and creative conveyor routing. The key is working with suppliers who have Brazilian experience and understand these spatial constraints.

Another common challenge is floor load capacity in older Brazilian warehouses. Before finalizing any layout, always conduct professional structural analysis. Reinforcing floors after equipment installation can add 30-50% to your project cost and significant timeline delays.

(coil packing line configuration, industrial coil packaging line, heavy duty coil packing line)

Conclusion

Choosing the right steel coil packing line supplier in Brazil requires careful evaluation of local support, equipment durability, and configuration matching to your specific throughput needs and facility constraints.